georgia film tax credit requirements

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in. The tax credit gets entered into the the step-by-step under Georgia Business and K-1 Credits.

Essential Guide Georgia Film Tax Credits Wrapbook

How to File a Withholding Film Tax Return.

. In most cases applications are reviewed and certified within 72. Third Party Bulk Filers add Access to a Withholding Film Tax Account. For the 20 Film Tax Credit certification must be applied for within 90 days of principal photography.

Diversity Management Satisfy diversity pay data requirements. Offset up to 100 Corporate Income Tax. Credit Code 122 company name is the movie company no.

Georgia film tax credit requirements Tuesday May 31 2022 Edit. Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute Pin On The Video Business Essential. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

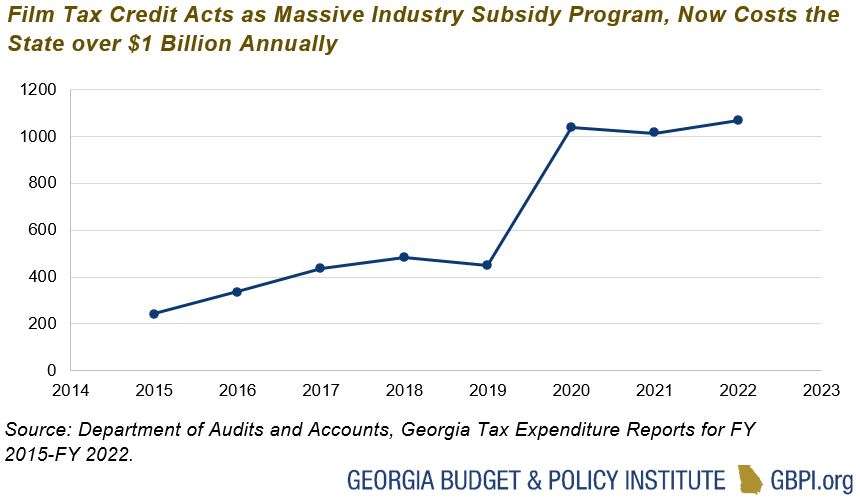

Georgia doled out a record 12 billion in film and tv tax credits last year far surpassing the incentives offered by any other state. Click to learn additional information and to obtain the GDORs application form. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out.

How-To Directions for Film Tax Credit Withholding. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. Central Casting Get found.

Claim Withholding reported on. Georgias Entertainment Industry Investment Act provides a 20 tax credit for filming and entertainment industries that spend 500000 or more on production and post. We offer film tax credits nationwide to ofset corporate individual tax liabilities for major studios and independent production companies.

Television films pilots or series. By News on April 19 2018 Features. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

An additional 10 credit can be obtained if the. Chunn SALT Senior Manager. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the.

Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements 0. The verification reviews will be done on a first comefirst serve basis. Learn about the changes to the Georgia Film Tax Credit scheduled to go into effect in 2021 and new requirements including an independent audit - Atlanta CPA.

And music videos that are distributed outside of. Register for a Withholding Film Tax Account. Instructions for Production Companies.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. Join our talent database. Direct contact for an audit.

The Georgia Department of Revenue GDOR offers a voluntary program. An audit is required prior to utilization or transfer of any. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of.

Global tax credit and incentives solution. The film tax credit percentage amount either 20 percent or 30 percent. Companies for services performed in Georgia when getting the Georgia.

This is an easy way to reduce your Georgia tax liability. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. On August 4 2020 Governor Kemp signed into law HB.

A Base Certification Application may be. Certification for live action projects will be through the Georgia Film Office. Film tax credit GA.

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Eue Screen Gems Film Movie Production Complex In Atlanta Ga Atlanta Hotels Sound Stage Downtown Hotels

Essential Guide Georgia Film Tax Credits Wrapbook

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Georgia Film Academy Atlanta Technical College

Essential Guide Georgia Film Tax Credits Wrapbook

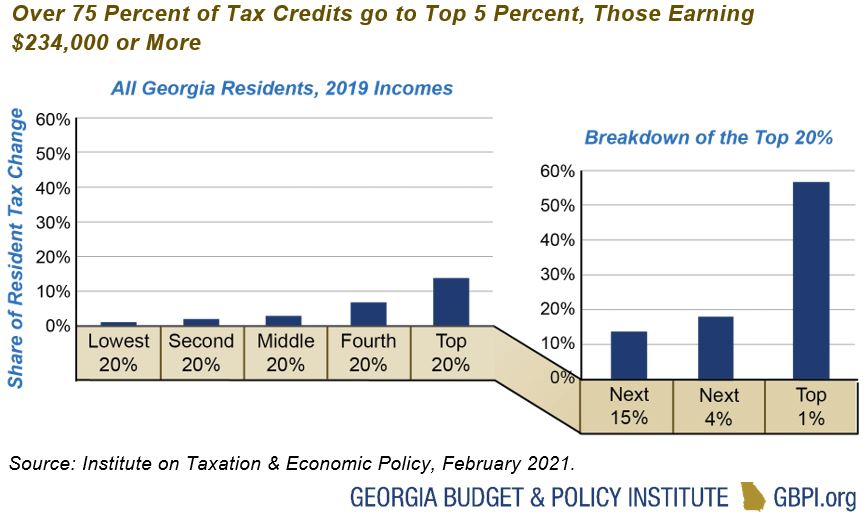

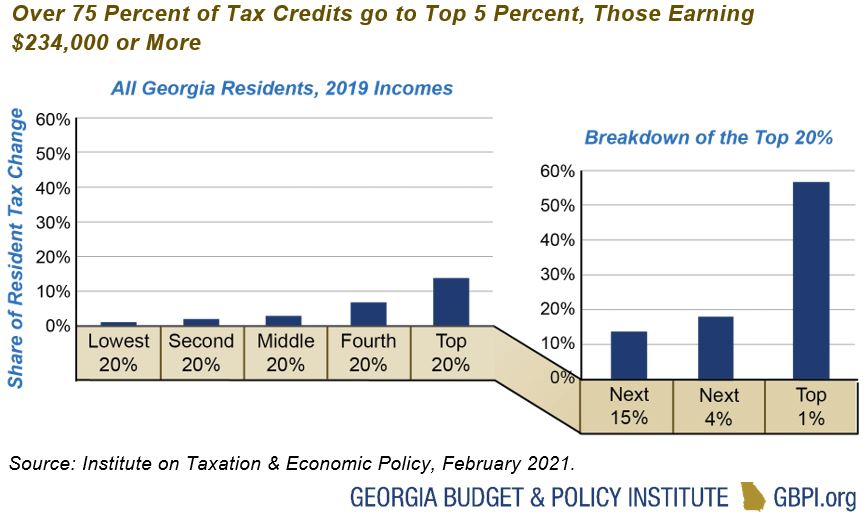

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

The Secret Sauce Of Georgia S Extraordinary Film Industry Georgians Saportareport

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film Incentives State By State Breakdown 2021 Sethero

Essential Guide Georgia Film Tax Credits Wrapbook

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle