tax air freight rules tariff

Unless otherwise provided exceptions to rules of the National Motor Freight Classification herein take precedence over those published in the National Motor Freight Classification. Tax-Air is a leading provider of logistics and transportation services and has been a trusted partner in the freight forwarding industry for 40 years.

TACT air cargo solutions are accessible in different formats.

. Thus if you import a container of 1000 of those products you would pay a 1150 tariff. Every tariff code is associated with an import tax rate typically 0 18 in a. But when referring to the goods being shipped.

13-1-2017 By- KASTURI SETHI. This document may qualify as a guidance document as set forth in Executive Order 13891 and interpretations thereof. Services provided under this item do not include charges for service to floors above or below the level accessible to Carriers vehicle or any other applicable charges.

As an example the general air cargo rate for a PVG-LAX 5000 value shipment weighing 500 kg would have been around 1650. However costs have risen sharply since February 2020 as a result of severe disruptions in ocean freight and high consumer demand. UPS Hundredweight Service.

The 10 tariff added 500 and the additional tariff another 750 in duties. Such guidance documents are not binding and lack the force and effect of law except as authorized. Its advantages include the change in tax charges with varying import prices unlike a specific tariff and tend to maintain a constant degree of protection for domestic producers as a result.

All references in this tariff to Bill of Lading terms published by the National Motor. Services include LTL Truckload Logistics Warehousing and more. Customs or In Bond Freight Charge per 100 pounds.

In most instances trying to arrange last-minute air freight would not have been financially feasible. A freight carrier you can count on. In a typical season international air cargo rates can range from approximately 250-500 per kilogram depending on the type of cargo youre shipping and available space.

Streamlined tariffs become deemed lawful and effective 7 days for rate reductions and 15 days for rate increases and changes in terms and conditions after the date the tariff was filed unless the FCC either rejects the tariff or suspends and investigates the tariff before the relevant time period has elapsed. Specific Tariffs as you may have expected are tariff rates charged as a fixed dollar amount per unit of imported goods. Section 14of Customs Duty Act provides that for the purposes of the Customs Tariff Act 1975 51 of 1975 the value of the imported goods and export goods shall be the transaction value of such goods that is to say.

Whether through the web or integrated with your system our solutions will improve your shipment processing time and free up time so that you can focus on your business. Broker Diversion at USMexico Border 821-3 63 Brokerage-Inclusive 485 15 Bulk Mail 365 9 Calculation of Cube 192 6. Tax-Air Terms Conditions for the Regional Carrier Division and the Nationwide Services Division.

UPS Next Day Air Early UPS Next Day Air UPS Next Day Air Saver UPS 2nd Day Air AM UPS 2nd Day Air UPS Hundredweight Air Services includes. They are openly accessible. The HTS is a reference manual that is the size of an.

Currently air cargo rates range from. Application and Precedence of Rules and Tariffs190 5 Bills of Lading Freight Bills and Statement of Charges 360 8 3900 per request per shipment. With TACT Online you can search and consult the entire content of TACT Rules Rates and Schedules.

View and access the full SEFL 1090 Rules Special Services Tariff or see below for a listing of the most commonly requested special services and charges for each. File Type PDF Air Cargo Tariff Manual ameamericansamoagov Complete Guide to Air Freight Procedures - Global Sep 21 2015 The Harmonized Tariff System HTS provides duty rates for virtually every item that exists. National sales and local taxes and in some instances customs fees are often charged in addition to the tariff.

Proper Deductions for Freight Other Costs. Compare the solutions now. UPS Ground with Freight Pricing UPS Hundredweight Service Ground UPS Returns Services UPS Air Services includes.

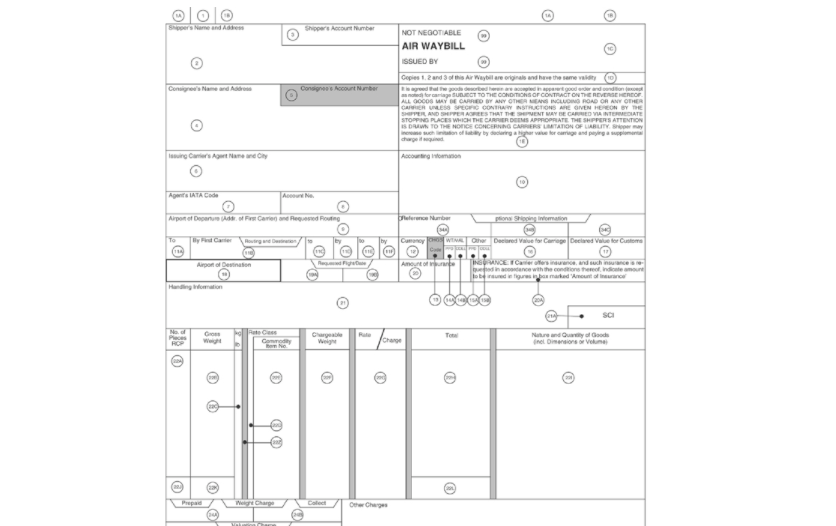

A fee of 18500 will be charged per shipment. The Air Cargo Tariff and Rules TACT The ultimate reference for air cargo transportation. Air freight and air cargo are generally the same.

The Air Cargo Tariff and Rules TACT provides air cargo professionals with the comprehensive information they require to efficiently transport air cargo worldwide. Different tariffs applied on different products by different countries. Accordingly no Service Tax could be levied on Ocean freight and air freight paid for import of goods prior to 0162016.

A fee of 8500 will be charged per shipment. Informed Compliance Publication. IATAs solutions are fast reliable and very easy to use.

An Ad Valorem tariff is a tariff that charges a fixed percentage of the monetary value of the imported product. The government may assign a 115 Specific Tariff to a certain product. When you talk about air freight and air cargo the term can mean a difference in the merchandise being shipped versus money charged for the shipment.

What Every Member of the Trade Community Should Know About. A fee of 53000 will be charged per shipment. Blind Shipments 822 38 16600 per shipment.

What Is an Air Cargo Tariff. Air freight service is not enumberated in the reverse charge notification no. Customs schedule HTS lists the tariff code associated with each product.

Charges for this service will be assessed a rate of 1000 per 100 pounds subject to a minimum charge of 9500 and a maximum charge of 60000. A fee of 13500 will be charged per shipment. A fee of 40000 will be charged per shipment.

Air cargo tariffs are determined by each air carrier or at the industry level. RL Carriers freight shipping and logistics company. A tariff or duty the words are used interchangeably is a tax levied by governments on the value including freight and insurance of imported products.

Application of the FedEx Freight 100 Series Rules Tariff. 302012-ST and hence not liable to pay service tax under reverse charge basisThanks.

How To Read And Understand Your International Airfreight Bill

Freight From Vietnam To Hong Kong Rates Transit Times Duties Taxes

How To Read And Understand Your International Airfreight Bill

Iata Air Cargo Tariffs And Rules What You Need To Know

Service Area Transit Time Tax Air

How To Read And Understand Your International Airfreight Bill

Air Freight Quotation How To Understand Tiba

Service Area Transit Time Tax Air

How To Read And Understand Your International Airfreight Bill

Frequently Asked Questions About Air Freight Gocomet

Air Freight Quotation How To Understand Tiba

Service Area Transit Time Tax Air

Iata Air Cargo Tariffs And Rules What You Need To Know

Service Area Transit Time Tax Air

Service Area Transit Time Tax Air

Iata Air Cargo Tariffs And Rules What You Need To Know

Air Cargo Terms And Abbreviations United Worldwide Logistics

How To Read And Understand Your International Airfreight Bill